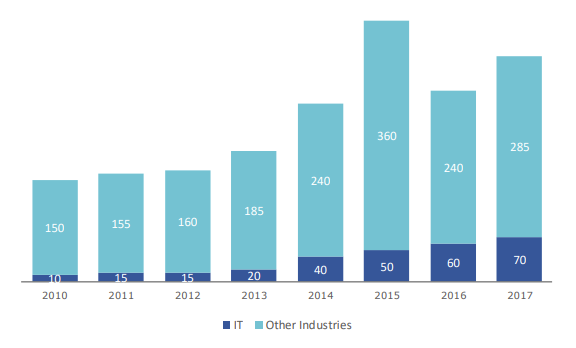

The secular growth outlook for the Tech sector has also attracted consistently growing interest from private equity investors. Below we show European annual private equity deal values by sector.

Even in down years for total private equity transactions, such as in 2016, Tech deals increased in value. Overall Tech has consistently outperformed and increased its share of total PE transactions.

We believe this is due to the following reasons:

- The attractive growth profile of the sector makes it suitable to support the high-leverage

- structure of PE buyouts

- Companies that are run for growth can often benefit from a more efficient operating approach of the PE model

- PE is often able to sell smaller and mid-sized Tech businesses to larger corporates, who continue to consolidate the sector. We believe a clean/full exit is the preferred route for PE compared to the more staggered exits that IPO’s typically provide.

On a global level, the 5 most active PE investors in Tech have been the following:

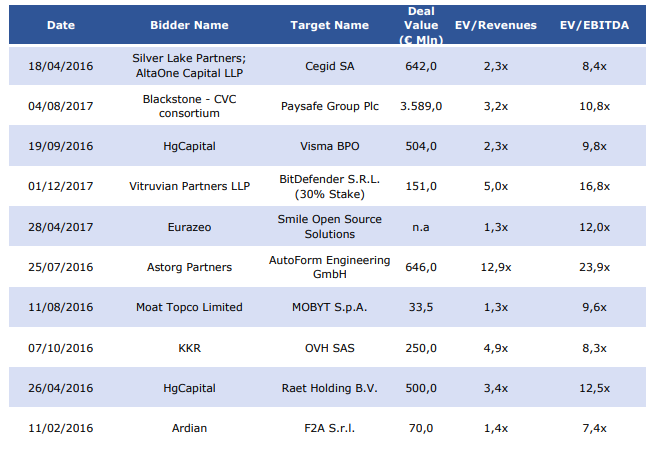

Below we show a selection of European private equity transactions in 2016&17 across different Tech subsectors and market caps.

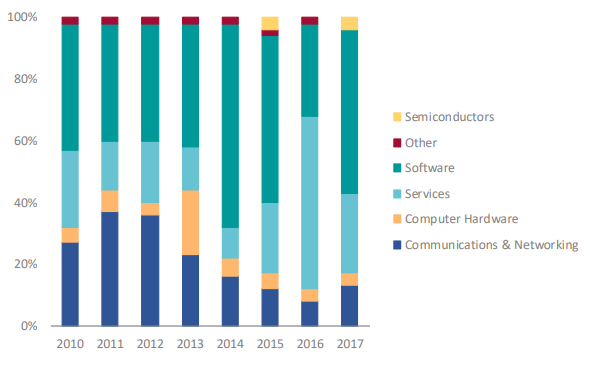

From a sub-sector perspective Software, IT Services and Payments/FinTech seem to be the clear favorites amongst PE investors in Europe. This is supported by global PE buyout data, which shows Software and IT Services typically make up 80% of Tech deal values.

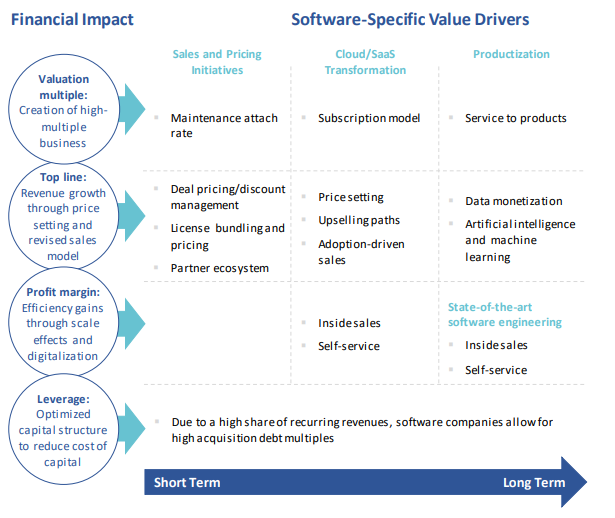

We believe there are several characteristics that make Software & IT service companies attractive for PE investors:

- Both Tech sub-sectors are fragmented, particularly in the small- and midcap segment. This offers the opportunity to ‘roll up’ acquisitions generating material cost synergies and scale benefits.

- A high share of recurring or ‘quasi-recurring’ revenues, helped by typically low customer churn. Software specifically is usually deeply integrated into business processes and systems. This means significant effort and investments are required to switch vendors.

- High gross and operating margins and secular growth driven by share gains of IT wallets in the Software sector.

- Low capex/capital intensity as these are ‘people-heavy’ but ‘asset light’ business models

- For Software specifically, a highly scalable business model with low deployment and upgrade costs.

- Multiple levers to extract value from existing offerings such as price increases, bundling & discounting.

Would you like to know more about current market trends?

Learn more in the Market Context Expertise section.